- Solutions

- Resources

- Pricing

- Company

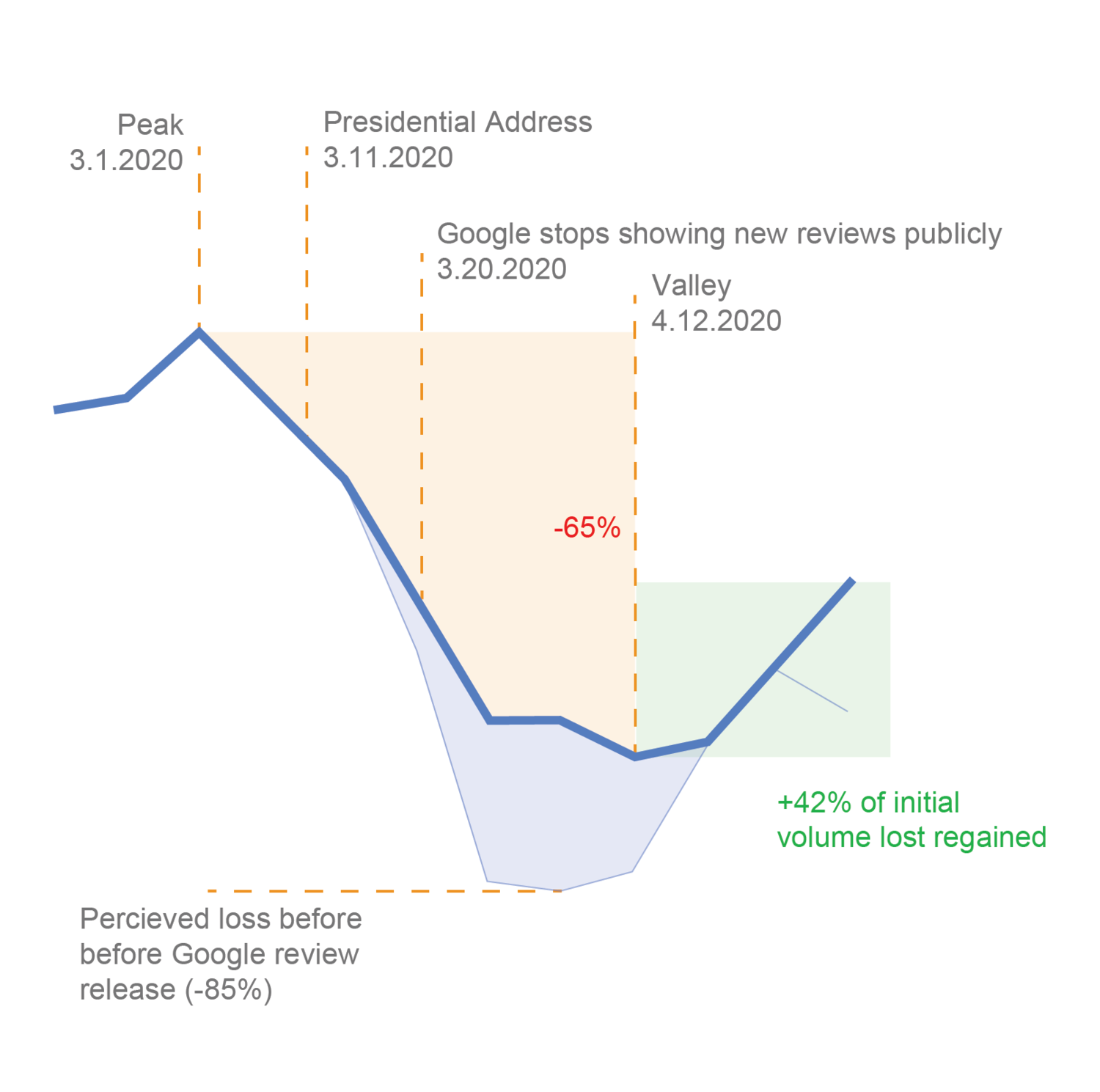

Due to COVID-19, average weekly consumer review volume was down 65% in April from its early March peak but has since regained 42% of the initial loss.

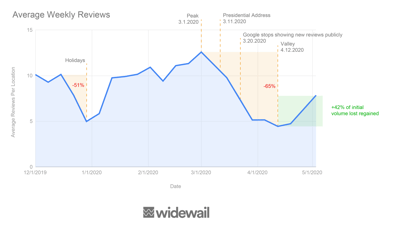

The following is an overview of average weekly dealership review volume between 12/1/19 and 5/1/20.

Without reading ahead, ask yourself the question, “What happened to car dealership online review volume as a result of COVID-19?” We all likely share a gut instinct that it has declined. That’s a no-brainer given the post-transaction nature of the review. If there are fewer transactions, there are fewer people to ask for reviews. Pretty straightforward.

But how large was this reduction in volume? Are dealers still seeing diminished volume? How close are we to recovering normal review volume on a weekly/monthly basis?

Even before the pandemic, reviews served as an interesting indicator of business health, especially for those businesses who actively solicit feedback from every customer. At Widewail we are also directly impacted by fluctuation in review volume, as we manage reviews on behalf of our customers. Considering our unique position, we thought it was important to dig into these questions.

The headlines from this data are clear:

Review volume declined roughly 65% from the 2020 peak to trough.

This decline happened over the span of approximately six weeks.

The trough lasted approximately three weeks.

At its lowest point during March, review volume was equivalent to what we see around the end-of-year holiday season.

Recovery is certainly underway, with plenty of room to improve.

The chart below shows the average weekly review volume per rooftop from 12/1/19 to 5/1/2020. We’ve marked a few recognizable dates to help you orient yourself.

If you follow Google news or general digital marketing updates you likely know that Google reviews were not posting live from March 20th through April 9th. Customers had the ability to leave a review in the same manner they always have, but it would not show up on the business’s Google My Business page or be counted towards their lifetime total of reviews. The reviewer could see their review, the business could not.

On April 9th, Google started allowing reviews to be posted live again. However, this was only for NEW reviews. Reviews written during the downtime remained hidden. We wondered what would happen to these reviews. Would they ever be visible?

On May 4th we got our answer. All the reviews left during the down period were pushed live by Google and released by the Google API. A deluge of reviews came into Widewail, forcing us to rally in support of our customers and partners.

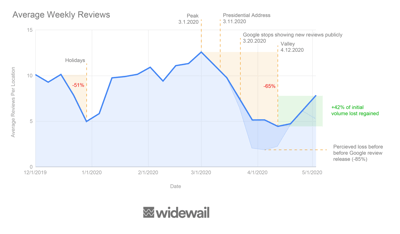

The data above incorporates all of those Google reviews when they were submitted by the user, not posted by Google, to ensure we have a clear picture of customer activity. Regardless of whether the review was visible, the customer took the steps to leave the review. We include it to show an accurate picture of review activity during this time period. For a more comprehensive view, the graph below demonstrates the difference in perceived volume loss vs. actual volume loss.

Historically, May is a big month for car dealers. The weather improves nationwide, customers receive tax refund checks, and dealers advertise down payment programs utilizing these refunds, all leading to a high volume of sales. Review volume normally shows its first peak of the year in May. We write this on May 7th and, as you can see, we are still far below the March 1st peak. Interestingly, volume loss from COVID is only 14 points greater than the loss experienced during the holiday season.

Furthermore, when we ran the data without backfilling the held reviews, we found the volume loss to be 85%. For businesses that track their review volume, the pause in reviews may have felt like a total shutdown. In reality, the actual performance was only a 65% decrease from the peak.

The good news - we’re in recovery. As of May 1st, car dealer review volume has rebounded from a low of 4.5 reviews per week to nearly 8 reviews per week, and volume is still on the rise. This means customers are returning to the service bays and showroom floors, music to the industry’s ears.

Surpassing 12 reviews per week per dealership will be a significant milestone as it will signal transaction levels at or above the March 1 volume. It is likely that pent up demand and the return of some levels of consumer confidence will continue to drive transaction volume in the coming months, with reviews following the trend.

I’m the Director of Marketing here at Widewail, as well as a husband and new dad outside the office. I'm in Vermont by way of Boston, where I grew the CarGurus YouTube channel from 0 to 100k subscribers. I love the outdoors and hate to be hot, so I’m doing just fine in the arctic Vermont we call home. Fun fact: I met my wife on the shuttle bus at Baltimore airport. Thanks for reading Widewail’s content!

Bite-sized, to-the-point, trend-driven local marketing stories and tactics.

U3GM Blog Post Comments