The fourth largest city in the United States and the largest city in the great state of Texas, Houston is a bustling hub for culture and commerce.

Often known for its contributions to space exploration and its diverse cuisine, Houston also has a unique car culture. One style that originated from Houston, a souped-up lowrider called a SLAB (“slow, low, and bangin’”), has a strong stereo, low to the ground frame, and often features spiked rims.

Houston’s eccentric car culture is on full display during the city's “Houston Art Car Parade,” which annually brings 250 decked-out “art cars” and more than 250,000 spectators to the city's streets.

Currently, Houston houses automotive manufacturers such as Tobisha, which manufactures electric motors, and other companies that produce truck bodies and trailers. With Houston’s strong connection to car culture and the automobile industry, it’s no surprise they also have a competitive landscape for automotive dealerships.

Dealerships in Houston showcase strong review response rates, high Google star ratings, and significant review volume. To earn the best reputation in Houston, dealers must provide top-notch service while actively soliciting reviews from customers.

Using the Automotive Reputation Index, which ranks dealers by volume, rating, and response rate, we’ve identified the Houston dealerships with the best online reputations.

.png?width=2111&height=2044&name=Top_Dealers_in_Houston_TX_(2).png)

-

The Sterling McCall family of dealerships in the Houston, TX area is in a league of its own in our Reputation Index, commanding four of the top five positions among overall dealers. Strong relative lifetime volume set its Lexus and Toyota dealerships apart at the top of the list here.

-

Wedging itself into the #3 spot among overall dealers is Don McGill Toyota. The only category holding this dealership out of the #1 spot is its lower relative lifetime volume. But with the highest monthly volume on this list, we expect to see Don McGill Toyota continue to strengthen its health score and climb the rankings as its lifetime volume grows.

-

The #10 position belongs to Mac Haik CDJ North. This dealership boasts a strong monthly review volume but only responds to 79% of its reviews, thus hindering its response rate. Implementing an improved review response strategy would surely improve its position in our reputation index.

.png?width=2003&height=2019&name=Top_Luxury_Dealers_in_Houston_TX_(1).png)

-

It should come as no surprise that Sterling McCall Lexus and Sterling McCall Lexus Clear Lake sit atop the rankings for luxury dealerships in Houston. High review volumes and solid response rates make these teams tough to beat. Sterling McCall Lexus could even further its lead on the competition by improving its adjusted rating with a strategy designed to earn reviews from happy customers.

-

Mercedez-Benz of Houston Greenway comes in at #4 on our Reputation Index. It boasts strong numbers in most categories, but would likely benefit from addressing its adjusted rating which sits at just 4.31. Much like Sterling McCall Lexus, this dealership would benefit from raising this number by improving the customer experience.

.png?width=2003&height=2019&name=Top_Luxury_Dealers_in_Houston_TX-1_(1).png)

-

Steele South Loop Hyundai comes in at #4 among non-luxury dealerships in Houston, TX. Its strong monthly review volume is great to see, but its middling response rate of just 77% prevents it from threatening the positions of the aforementioned top 3 from the overall rankings. Addressing this weakness would make it a contender for the strongest index rating among this group of dealerships.

-

Tom Peacock Nissan has a similar total rating to the previously mentioned dealership, but its shortcoming is just the opposite. Its near-perfect response rate of 99% is fantastic, but its review volume lags slightly behind the dealerships that are ahead of it. Soliciting more reviews would certainly improve this dealer’s overall rating.

*Note from the editor. The Automotive Reputation Index offers substantial coverage of the nation’s dealerships, but it’s still growing. If your dealership is not yet listed on the Index and you’d like to add it, submit your information and we will add it during a regularly scheduled update, roughly once per month.

Widewail's rankings are based on the Widewail Automotive Reputation Index. Explore the full dataset:

Ranking Methodology

To rank these dealerships fairly, we chose a method that considers the fact that dealerships on our list receive a wide range of monthly review volume, in part due to varying levels of opportunity. For example, luxury brands can never sell as many cars as non-luxury brands, the price point limiting a luxury dealership's market.

To compare two dealerships with very different review volumes directly wouldn’t be fair. A dealer with two 5-star reviews doesn’t necessarily deserve to be ranked higher than a dealer with 200 reviews and a 4.5-star rating. With few reviews, the former doesn’t offer enough data for us to use to understand its performance. However, we couldn’t just ignore locations with very few reviews, as that would introduce bias into our rankings.

To solve this, we used "adjusted ratings" in our calculation of dealership ranking. In essence, "adjusted rating" is a dealership's star rating that takes into account how its review volume compares to that of other dealerships in that area. We calculated adjusted ratings by using a technique called additive smoothing which we explain below.

Additive Smoothing

The approach we’ve used is a form of what’s called “additive smoothing.” This process allows for an unbiased way to rank two otherwise unequal dealerships. At its core, additive smoothing levels the playing field by artificially increasing the number of reviews each dealership has by adding the same number of reviews of each star rating to every dealership.

Customer Engagement

Additionally, we take into account the percentage of reviews that a dealership has responded to in our calculation of ranking, as Widewail strongly believes that review response is indicative of a strong reputation strategy.

Activity

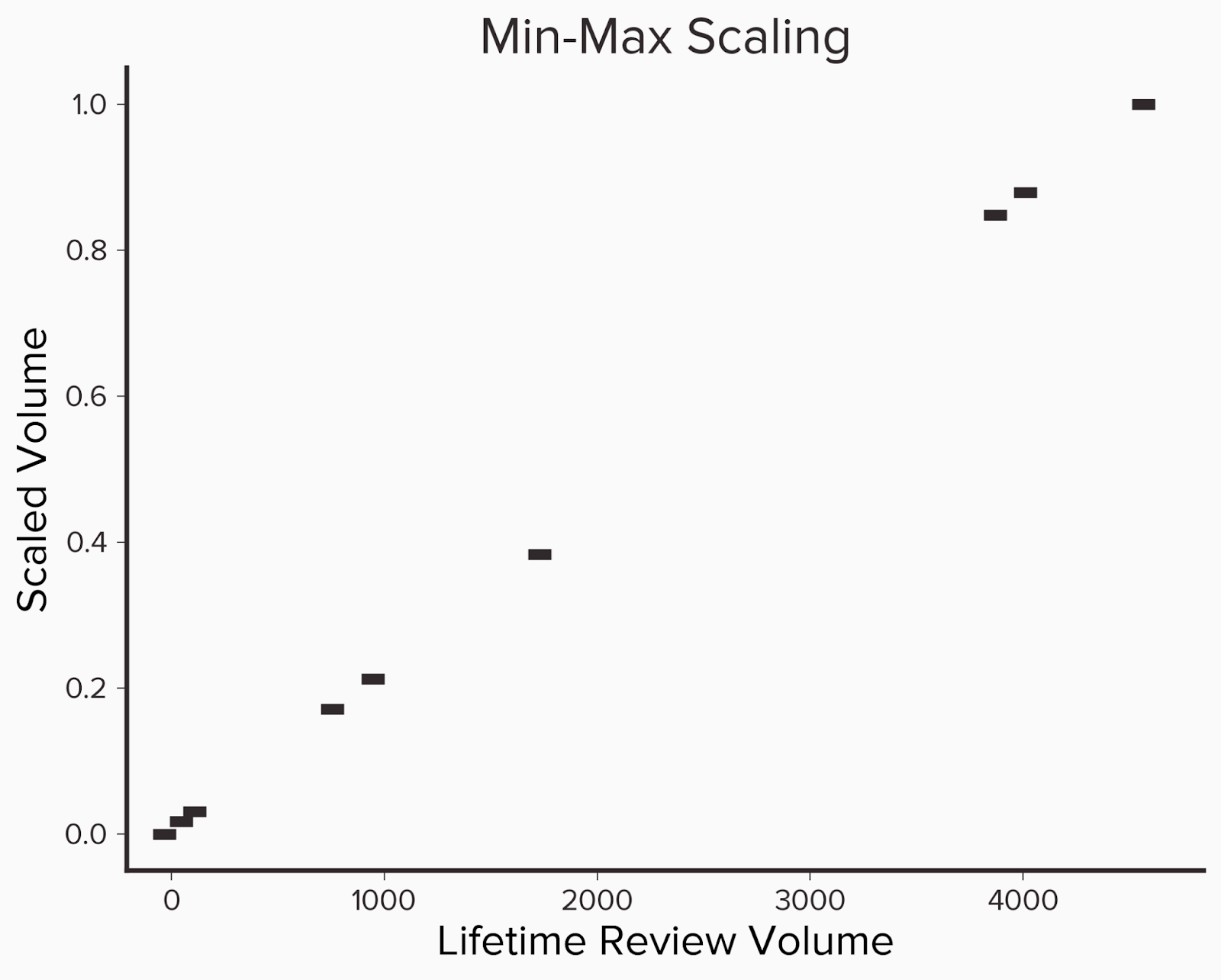

The last component revolves around how much review volume a dealership receives, which can be broken down into two parts - their lifetime volume and average monthly volume. Lifetime volume can be thought of as a popularity metric. It’s an important metric and one of the first numbers that a potential customer will see when they start looking at reviews. The second, average monthly review volume, is representative of how active the dealership currently is. We can think of it as follows, lifetime volume captures a historical view of the dealership whereas average volume gives insight into the current status. The final component for the volume metrics is to scale them so there is a more meaningful comparison. To do this we use what is known as min-max scaling. First we group dealerships by their respective city and then find the dealership with the most volume and least volume. Then for each dealer in the group, we subtract the lowest volume and divide by the difference between the highest and lowest volume. The formula for this can be seen below.

x' = x - min(x)max(x) - min(x)

The main advantages of this approach are that all the volume metrics can be mapped to a value between 0 and 1 and the relative difference between dealership volumes can still be preserved.

Below we see an example of this where we have 9 dealerships with differing lifetime volumes, which we then scale. Notice that the relative distance between the actual volumes and the scaled versions is the same.

Below we have an example of ten dealerships, their review volume, and the adjusted relative volume. We can calculate the relative volume by sorting the dealers by review volume and determining the percentage of dealers that have fewer reviews. Here we see that dealer D had the most reviews and so they get a score of 1.

|

Lifetime Volume

|

Scaled Volume

|

|

4619

|

1

|

|

4065

|

0.88

|

|

3922

|

0.85

|

|

1783

|

0.38

|

|

1001

|

0.21

|

|

810

|

0.17

|

|

164

|

0.03

|

|

101

|

0.02

|

|

22

|

0

|

The Ranking Formula

(adjusted rating / 5) * 0.3 + (response rate) * 0.3 + (lifetime volume) * 0.15 + (avg monthly volume) * 0.25

Weighting Rational

We chose to weigh each feature as follows: adjusted rating accounts for 30% of the overall score, response rate also accounts for 30%, and review volume is 40%, which is further broken down into lifetime volume (15%) and average monthly volume (25%).

Weight selection is based on Widewail’s depth of expertise in the industry and we believe is a fair representation of what should be considered a standout reputation.

We’ve broken the weighs into three categories:

Activity (40%)

We believe the amount of review activity is the most important indicator of reputation health for a business, and is a leading driver of local search rankings. We’ve broken this category into two components: lifetime volume (15%) and frequency (25%). Lifetime volume is our “popularity” metric.

Engagement (30%)

Engaging with customers by responding to reviews is a key component of a healthy reputation.

Quality (30%)

Rating has a substantial impact on if a business shows up in local searches and if that business is entered into a prospect’s consideration set. Rating is a key identifier of business health.

Calculation Details

If a company has an adjusted rating of 4.2, responds to 10% of their reviews and has an adjusted lifetime volume of 0.90 in their city and 0.87 for their scaled average monthly review volume, then we would calculate their overall rating as follows

(4.2 / 5) * 0.3 + (0.1)*0.3 + (0.9)*0.15 + (0.87)*0.25 = 0.252 + 0.03 + 0.135 + 0.2175 = 0.6345 * 100 = 63.45

Note: Since response rate accounts for 30% of the overall ranking, if a dealer doesn’t respond to any reviews that automatically caps the max value they can receive to 70.

.png?width=2111&height=2044&name=Top_Dealers_in_Houston_TX_(2).png)

.png?width=2003&height=2019&name=Top_Luxury_Dealers_in_Houston_TX_(1).png)

.png?width=2003&height=2019&name=Top_Luxury_Dealers_in_Houston_TX-1_(1).png)