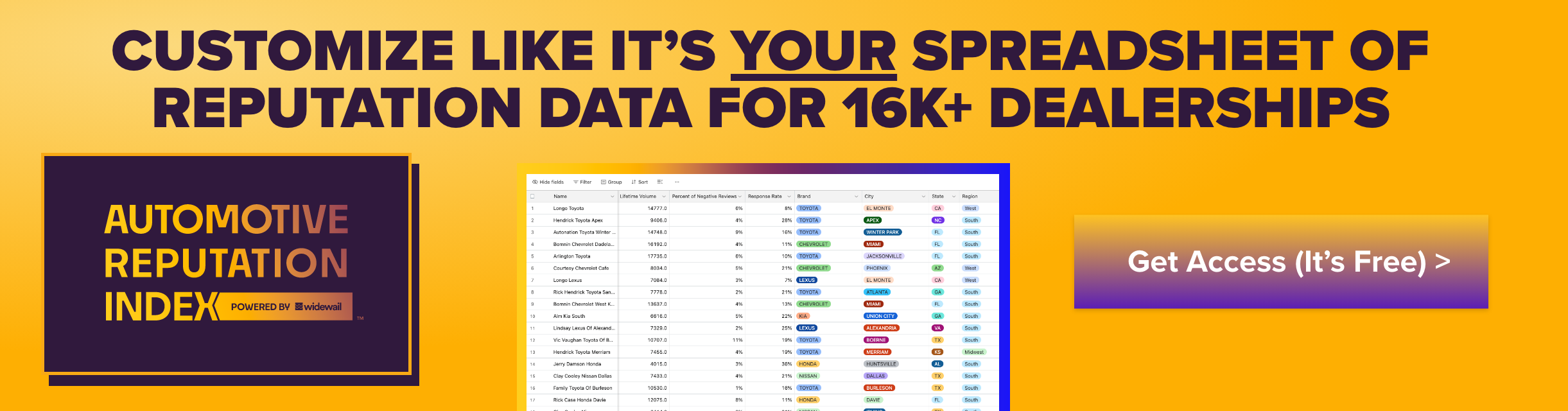

Access Reputation Index & More

The most comprehensive reputation data resources in automotive, brought to you by Widewail.- Widewail Automotive Reputation Index

- The REV Newsletter (1x/month)

- Industry Reports

1 of 6

Automotive Index Training: Basic Actions

2 of 6

Automotive Index Training: Basic Actions

Filter

-

In the top toolbar, click “Filter”

-

Focus on certain areas by filtering by categorical fields like "Brand" or "City"

-

Set conditional filters like "all dealers with an average rating greater than 4"

3 of 6

Get to Know the Reputation Data

This Widewail Automotive Reputation Index dataset consists of:

-

16,671 new car dealers in the U.S.

-

1.6M reviews

-

Google reviews only

-

Current Timeframe: February through June of 2023

4 of 6

What Does This All Mean?

Find definitions of each column header

In the row of column headers, you can hover over the ⓘ symbol next to each label to read the definition of what is being measured in that column and how the data was collected.

5 of 6

Where to Find Benchmarks

At the bottom of the table, you'll find aggregated numbers for each column. These are the benchmarks. We've preset the benchmarks in each column for you.

The benchmark data updates as you filter and sort the table, producing thousands of variations, each specific to your market or interests.

6 of 6

Common Use Cases & More

Below the Reputation Index table, you'll find a Common Use Cases section to get you started. Each common use case includes a how-to video.

The Automotive Reputation Index is ever-evolving. Check back regularly for updated data and new use cases. If your dealership is missing and you’d like to add it to the Index, select “Submit a request to add.”

Get Started